Your domestic affiliate program is a well-oiled machine. Your CPA is stable, your partners are happy, and your ROI is predictable. Then you decide to launch in Brazil or Southeast Asia. Within 90 days, you’re drowning in reconciliation errors, battling regulatory violations you didn’t know existed, and facing a revolt from partners who haven’t been paid in their local currency.

At AFFMaven, we’ve spent over 12 years analyzing the rise and fall of affiliate networks. We’ve seen hundreds of programs attempt global expansion, yet fewer than 20% succeed in creating a sustainable international footprint. The reason isn’t a lack of ambition—it’s a fundamental infrastructure deficit.

With the global affiliate industry valued at $21 billion in 2026 and projected to hit $31.7 billion by 2031, the opportunity is undeniable. But capturing this growth requires more than just translating your landing pages. It demands a complete operational overhaul.

This is the framework that separates the global players from the expensive failures.

🧱 The Infrastructure Trap: Why “Copy-Paste” Fails

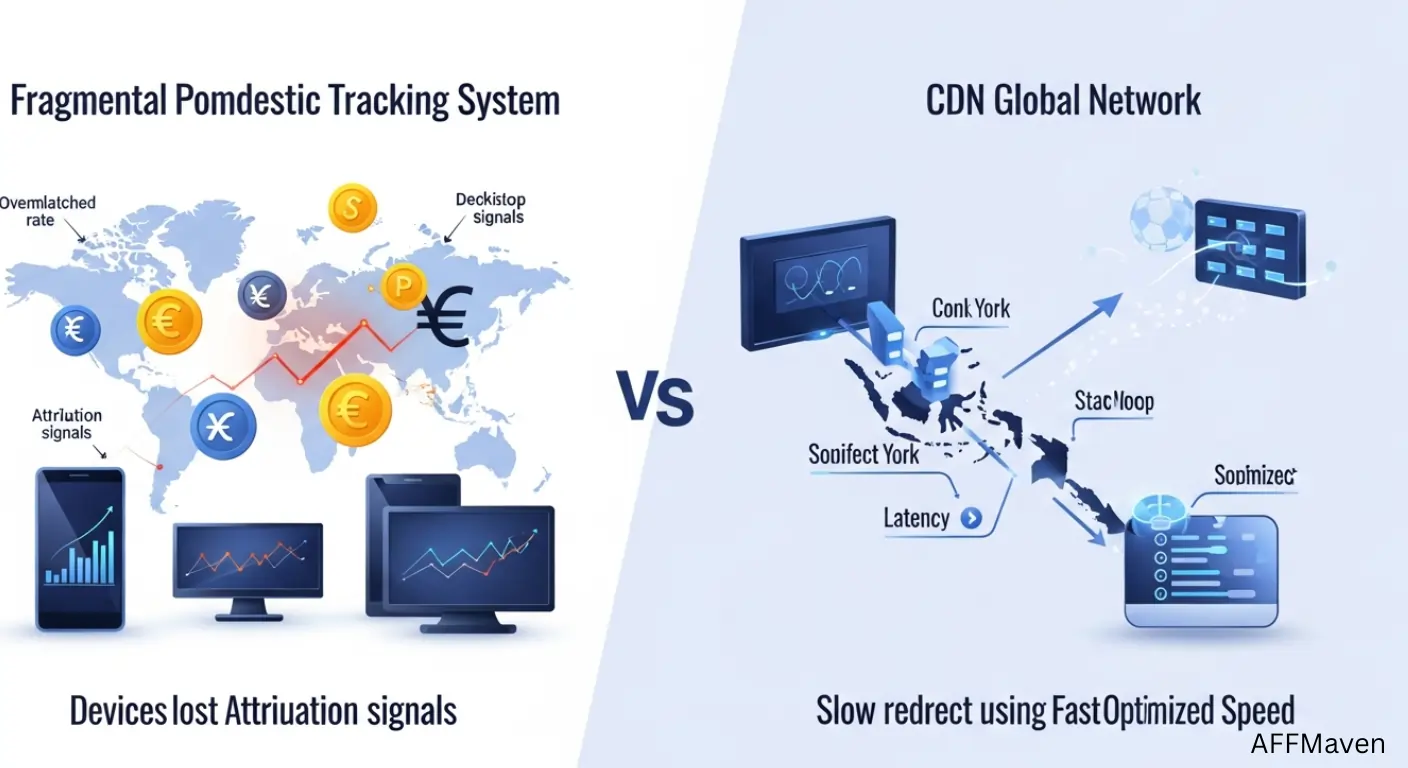

Most affiliate managers treat international expansion as a simple replication of their domestic strategy. This is the first fatal error. A tracking setup that works for the UK market is often woefully inadequate for multi-region operations.

⚙️ The Technical Debt of Domestic Platforms

If your tracking platform cannot natively handle multi-currency reconciliation, you are building on quicksand. We see programs manually calculating exchange rates at the end of the month—a recipe for disaster that leads to the 28% of affiliates who cite delayed payments as a major grievance.

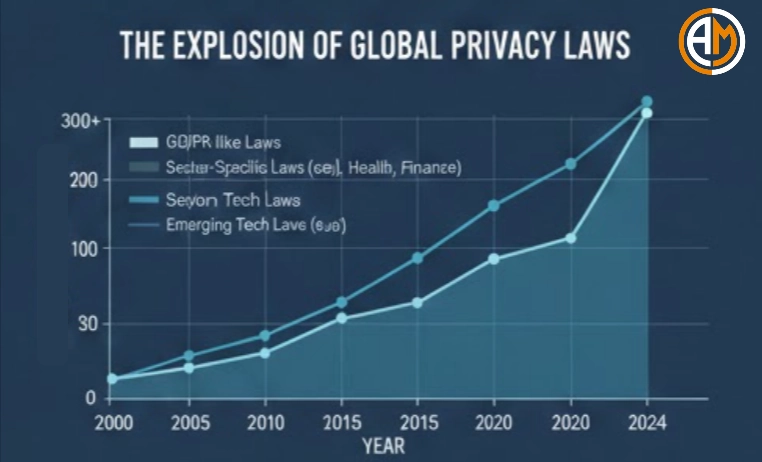

🌐 The Compliance Minefield: It’s Not Just GDPR Anymore

In 2026, compliance isn’t just about avoiding a slap on the wrist; it’s about survival. The total sum of GDPR fines reached €6.7 billion by late 2025, and regulators are actively targeting cross-border marketing schemes.

🚀 Beyond the EU

While you might be prepared for GDPR, are you ready for Brazil’s LGPD or California’s CCPA?

AFFMaven Insight: Don’t rely on a generic “Global Terms & Conditions” page. Implement Tiered Compliance Documentation. Create specific legal frameworks for each “Regulatory Zone” (Zone A: EU/UK, Zone B: North America, Zone C: LATAM/APAC) to insulate your program from regional risks.

💰 Financial Logistics: The Silent ROI Killer

You might have the best offer in the world, but if your partners in Vietnam can’t withdraw their earnings via local wallets, they won’t run your traffic.

💳 The Payment Friction Index

Programs that assume PayPal is a universal solution often fail. In many high-growth markets, PayPal penetration is low or fees are prohibitive.

📍 True Localization: Culture > Translation

The most expensive mistake we see at AFFMaven is “Language Localization” without “Cultural Localization.” Translating a banner ad into Spanish doesn’t make it relevant to a Mexican consumer.

📉 The Content Relevance Gap

📊 Strategic Market Readiness Matrix

Before you launch, audit your target markets against this readiness matrix. Don’t chase “Market Size” without “Operational Fit.”

| Market Region | Growth Potential (CAGR) | Compliance Risk | Payment Complexity | Maven Verdict |

|---|---|---|---|---|

| North America | Moderate (Stable) | Medium (CCPA/State Laws) | Low | Safe Bet. High competition but established infrastructure. |

| Latin America | High (12-18%) | High (LGPD, Tax Laws) | High (Pix/Local Methods needed) | High Reward. Requires local entity or specialized payment partner. |

| Asia-Pacific | Very High (25%+) | Varies (Fragmented) | Very High (Super-apps, Mobile-first) | Strategic Priority. Massive volume but requires distinct mobile-first strategy. |

| Europe (EEA) | Low/Moderate | Severe (GDPR/DSA) | Low (SEPA) | Defensive Play. Strict compliance keeps competitors out. High entry barrier. |

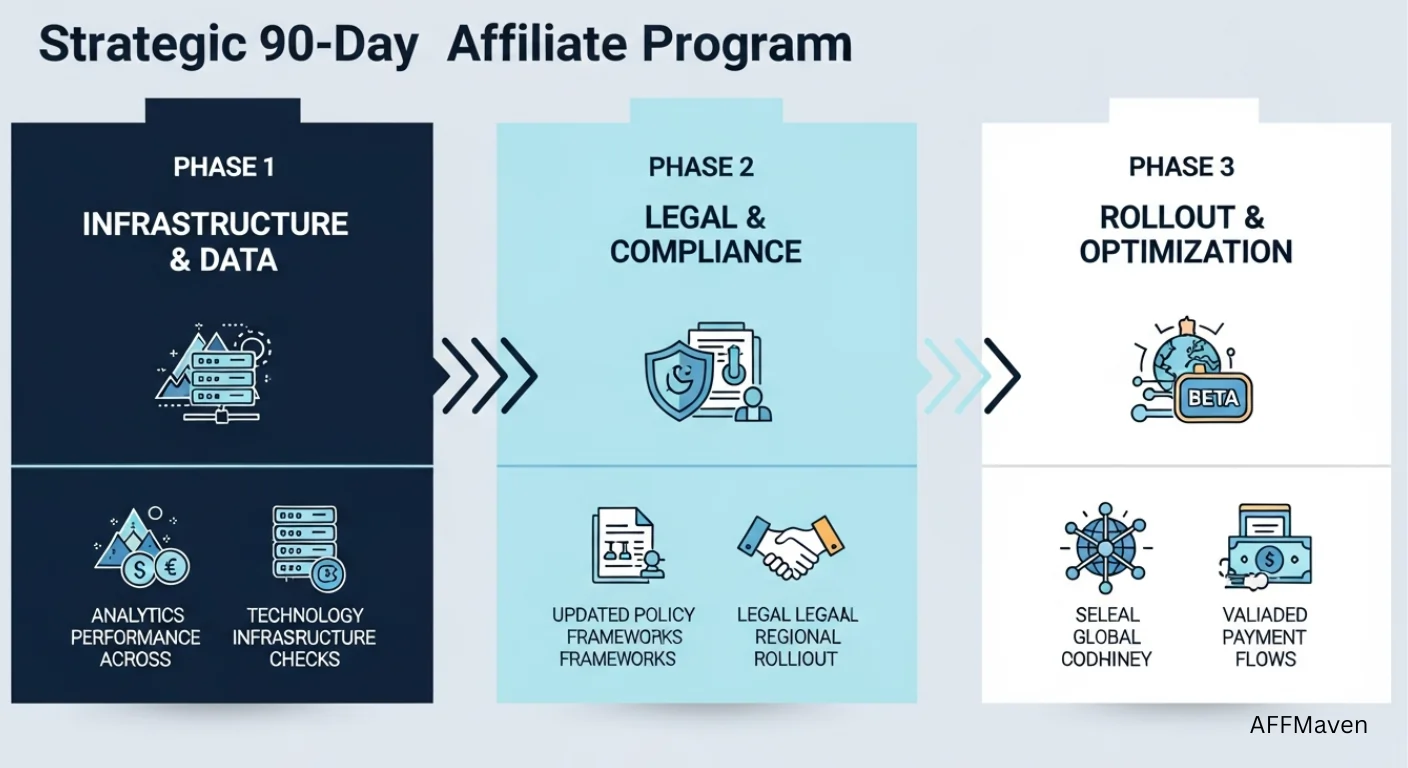

📅 The Maven Verdict: 90-Day Operational Framework

At AFFMaven, we believe that operational readiness beats market potential every time. Here is our recommended 90-day roadmap for 2026:

Phase 1: The Infrastructure Audit (Days 1-30)

Phase 2: The Compliance Shield (Days 31-60)

Phase 3: The “Soft” Launch (Days 61-90)

🌟 Conclusion

International expansion is not a marketing challenge; it is an operations challenge. The programs that win in 2026 won’t be the ones with the flashiest ads, but the ones with the boring stuff figured out: reliable pixels, compliant data policies, and on-time payments in local currencies.

Stop building your international castle on a domestic foundation. Secure your infrastructure first, and the revenue will follow.

Affiliate Disclosure: This post may contain some affiliate links, which means we may receive a commission if you purchase something that we recommend at no additional cost for you (none whatsoever!)